[ad_1]

The major shareholder groups in dMY Technology Team, Inc. VI (NYSE:DMYS) have electrical power about the business. Establishments usually own shares in a lot more founded firms, though it truly is not uncommon to see insiders personal a good bit of lesser organizations. I normally like to see some degree of insider possession, even if only a minimal. As Nassim Nicholas Taleb claimed, ‘Don’t tell me what you assume, notify me what you have in your portfolio.

dMY Technological innovation Team VI is not a significant company by world wide benchmarks. It has a current market capitalization of US$306m, which means it would not have the consideration of several institutional buyers. Having a look at our facts on the ownership groups (under), it seems that establishments have shares in the company. Let’s delve further into every single variety of operator, to learn more about dMY Know-how Team VI.

View our hottest investigation for dMY Technologies Group VI

What Does The Institutional Possession Notify Us About dMY Know-how Team VI?

Institutional traders typically assess their possess returns to the returns of a generally adopted index. So they usually do take into consideration purchasing bigger firms that are bundled in the related benchmark index.

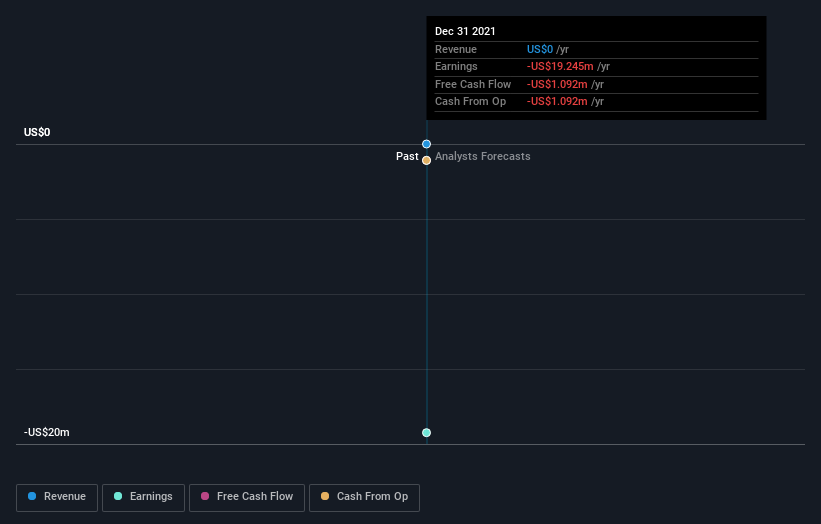

dMY Technological innovation Team VI presently has establishments on the share registry. In truth, they possess a respectable stake in the business. This can indicate that the enterprise has a particular diploma of reliability in the investment decision local community. Having said that, it is finest to be cautious of relying on the meant validation that arrives with institutional buyers. They as well, get it improper often. If multiple establishments change their perspective on a inventory at the exact same time, you could see the share price tag drop quickly. It really is as a result value on the lookout at dMY Technologies Group VI’s earnings background below. Of class, the long run is what definitely issues.

Institutional investors have over 50% of the corporation, so with each other than can almost certainly strongly influence board decisions. We note that hedge funds never have a meaningful expenditure in dMY Know-how Group VI. Our data exhibits that Harry You is the largest shareholder with 20% of shares remarkable. With 3.6% and 3.3% of the shares exceptional respectively, Governors Lane LP and Woodline Companions LP are the second and third biggest shareholders.

After accomplishing some additional digging, we found that the top 13 have the mixed possession of 51% in the business, suggesting that no solitary shareholder has important control over the enterprise.

Studying institutional ownership is a excellent way to gauge and filter a stock’s anticipated functionality. The exact can be realized by researching analyst sentiments. As significantly as we can tell there is not analyst coverage of the business, so it is most likely traveling less than the radar.

Insider Possession Of dMY Technologies Group VI

The definition of an insider can vary somewhat amongst distinct nations, but members of the board of directors always count. The firm management remedy to the board and the latter really should signify the pursuits of shareholders. Notably, from time to time top-stage managers are on the board on their own.

I frequently contemplate insider possession to be a fantastic matter. Having said that, on some situations it tends to make it extra difficult for other shareholders to maintain the board accountable for conclusions.

Our most latest details signifies that insiders have a sensible proportion of dMY Technology Team, Inc. VI. It has a current market capitalization of just US$306m, and insiders have US$60m value of shares in their personal names. We would say this displays alignment with shareholders, but it is truly worth noting that the company is nonetheless quite small some insiders may have launched the company. You can click on right here to see if people insiders have been getting or promoting.

Typical Public Ownership

The normal public– which includes retail traders — very own 25% stake in the organization, and for this reason cannot conveniently be disregarded. Whilst this size of ownership could not be ample to sway a coverage final decision in their favour, they can nonetheless make a collective impact on corporation insurance policies.

Following Techniques:

It is usually worth considering about the distinct groups who possess shares in a corporation. But to realize dMY Technologies Group VI much better, we have to have to think about several other aspects. Look at for occasion, the at any time-current spectre of investment decision threat. We’ve determined 4 warning indicators with dMY Engineering Team VI (at minimum 2 which are regarding) , and knowing them ought to be aspect of your expenditure method.

If you would want check out a different organization — one with potentially outstanding financials — then do not miss out on this no cost checklist of interesting companies, backed by strong fiscal information.

NB: Figures in this posting are calculated making use of facts from the past twelve months, which refer to the 12-month period ending on the previous day of the thirty day period the financial statement is dated. This could not be regular with complete calendar year once-a-year report figures.

Have suggestions on this article? Worried about the content? Get in contact with us directly. Alternatively, e mail editorial-team (at) simplywallst.com.

This post by Only Wall St is normal in character. We provide commentary primarily based on historic info and analyst forecasts only working with an impartial methodology and our article content are not supposed to be money information. It does not represent a recommendation to obtain or market any inventory, and does not consider account of your goals, or your financial situation. We purpose to deliver you prolonged-time period centered assessment pushed by elementary knowledge. Note that our examination may not element in the most up-to-date selling price-delicate business announcements or qualitative substance. Basically Wall St has no posture in any shares stated.

[ad_2]

Source connection