[ad_1]

Asian young woman paying with smartphone in a cafe. POS, PAX Global Asia-Pacific Images Studio/E+ via Getty Images

Investment Thesis

PAX Global Technology (OTCPK:PXGYF) (‘PAX’) – trades under ticker 0.327 on the Hang Seng stock market – was our top pick in 2020 after our initial research in 2019.

Our thesis worked out wonderfully. The company delivered better than expected growth and profitability, lifting the stock price from HK $3.5/share to HK $11/share. Even at the peak, the margin of safety and valuation were reasonable. One-third of the market cap was cash, valued at HK $3/share.

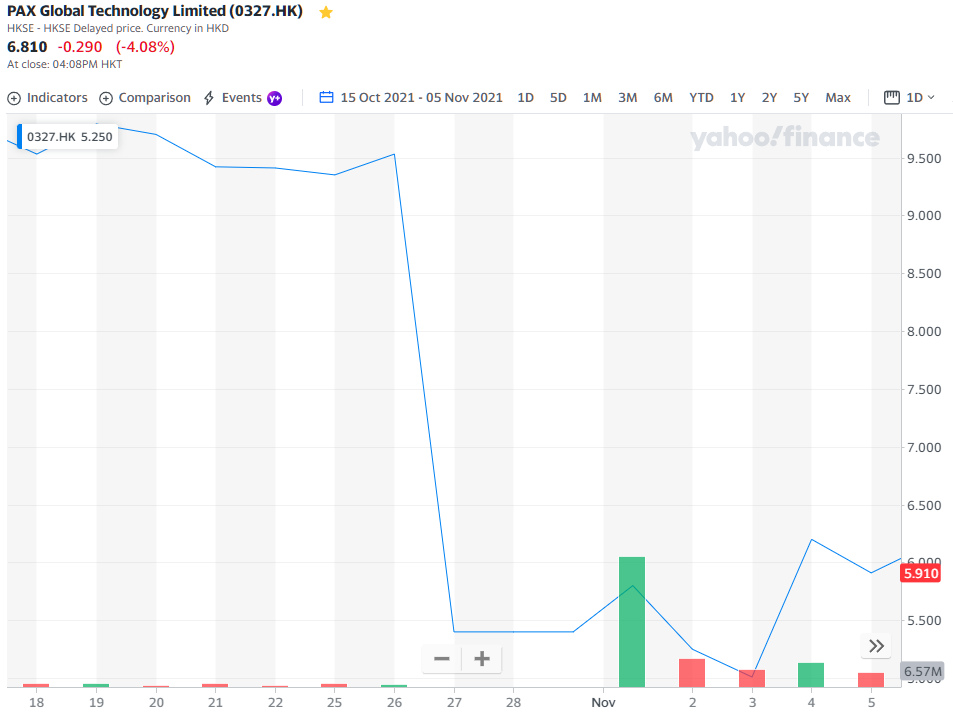

Then, out of nowhere, on Oct 26th, 2021, the ‘FBI raided Pax’s Florida facility’. The shocking news headline seemingly killed the bull thesis overnight. The stock cratered 50% to $4.50/share from $10/share.

Initially, we were shocked because of the negative headlines as it was our top position, but we decided not to act as we didn’t have the complete picture of what was going on. Today, PAX has released its FY2021 results, detailed management commentaries, incident reports from a reputable security company – Palo Alto Network, and, importantly, shared customers’ experiences after the incident. We can conclude that the impact is immaterial, and the alleged security breach is unsubstantiated.

This report also reviews the pertinent risks going forward, from the supply chain issue to the disruption in the technology landscape. We conclude that in the long term, the risks are manageable, and PAX has already overcome more significant problems in the past.

Since its IPO in 2010, the company overcame complex challenges in the collapse of the legacy Chinese market in 2014, the management outburst in 2015, the strategic pivot to expand internationally, the pandemic uncertainties, and the recent security breach in the US. Because of these achievements, we believe that the business is highly resilient and remains a compelling investment, a ‘‘picks and shovels’ play for the cashless economy.

PAX is a buy at HK $6.50/share (on the Hang Seng Stock Exchange, or USD $0.80 on the OTC), in market cap, that’s HK$ 7B (or USD $850M).

Elephant In The Room

First, let’s address the elephant in the room that could have killed our investment.

PAX’s share decline

PAX’s share price cratered 50% from HK $10 to HK $4.30 (at the lowest) on October 26th, 2021. Below is the cause of the implosion:

1. FBI’s raided PAX’s Florida facility

2. PAX Devices Sent Data to Chinese Third Parties, Treasury Warns

3. PAX Security Executive Resigns a Day After FBI Raids on Offices

4. FIS’s Worldpay Replaces PAX Terminals Over Security Concerns

One bad headline after another. And like dominoes, the initial news from the FBI led to an investigation by the Treasury’s Office of Cybersecurity and Critical Infrastructure Protection, then the resignation of three employees, one of which was an executive. Finally, it hit home when one of the most well-known players in the payment industry, Worldpay, ceased its contract with PAX.

However, underneath the shocking headlines, there were a lot of assumptions and false accusations. The FBI raided the Florida facility but didn’t uncover any wrongdoing. Then the Treasury conducted a preliminary assessment, only to indicate the possibility of risks without definitive findings. An executive left without any clarifications. And Worldpay replaced Pax’s POS in favor of Verifone and Ingenico, which are also based on, quote on quote, no evidence that data running through PAX POS devices has been compromised.

All those scary headlines appear to be ‘unsubstantiated’ and ‘immaterial’, in our view.

It was unsubstantiated because an independent investigation carried out by Unit 42, a specialized cyber threat investigator unit of Palo Alto Networks, a global cyber security provider, has analyzed network traffic to/from PAX terminals and has not found

[…] any malicious traffic or events in the network activity reviewed.

And that,

[…] PAX has adopted a responsible and transparent approach to the incident.

Source: 15th December press release and FY2021’s conference call

In more detail, the report found that

[…] there was no unexplained network traffic in the course of its comprehensive and thorough inspection. The activity associated with the initial sign-in, the transmission of cellular information, and/or information about the installed applications was unique for each PAX terminal. Therefore, packet sizes can vary, depending on, among others, the individual configuration of the PAX terminals.

Unit 42 concluded that

[…] In other words, there was no finding of unusual “data packets” or “network packets” referred to in the KrebsOnSecurity Article.

[…] the network traffic reviewed was consistent with the intended features of the associated services of PAX terminals.

The financial impact on the company is also immaterial, in our view. It created some delays for some new client’s projects. Some clients also stopped ordering for a month in October. However, most clients and IOS (Independent Sales Organizations) continued to use PAX’s devices. Additionally, the sales value dropped by Worldpay is also just USD$0.5M, or 0.54% of total sales (FY2021: USD$925M, HK$7.2B).

But let’s be cautious. Looking at the H1 and FY2021 results, one could speculate that the impact was more significant. The growth of the US business in H2 ’21 slowed to 56% YoY from 72% in H1. Could the security breach be the main culprit?

We think it’s a challenging conclusion. The drop could have coincided with the event due to PAX’s lumpy sales pattern. In addition, growth in the EMEA and APAC regions dropped in H2’21. Either way, we can’t conclude with the available information.

The management believes,

[…] the impact would be immaterial and

[…] that clients have started ordering PAX’s products again and

[…] we remain very confident in our US business

Source: PAX FY2021 conference call

On balance, the impact is minimal short-term. In the long run, we see it as positive as customers were reminded of the high quality of PAX’s products. In addition, they spoke to investors daily and held a Zoom conference on November 1st reporting early findings. Investors could see that the management was capable of handling the crisis successfully. Lastly, what spoke the most volume was their repurchase of shares between HK $5 and $6.50. The management is well-aligned with investors and has continued to buy back shares even in recent months.

FY2021 – Targets Achieved

With the elephant in the room issue out of the way, let’s review the FY2021 results.

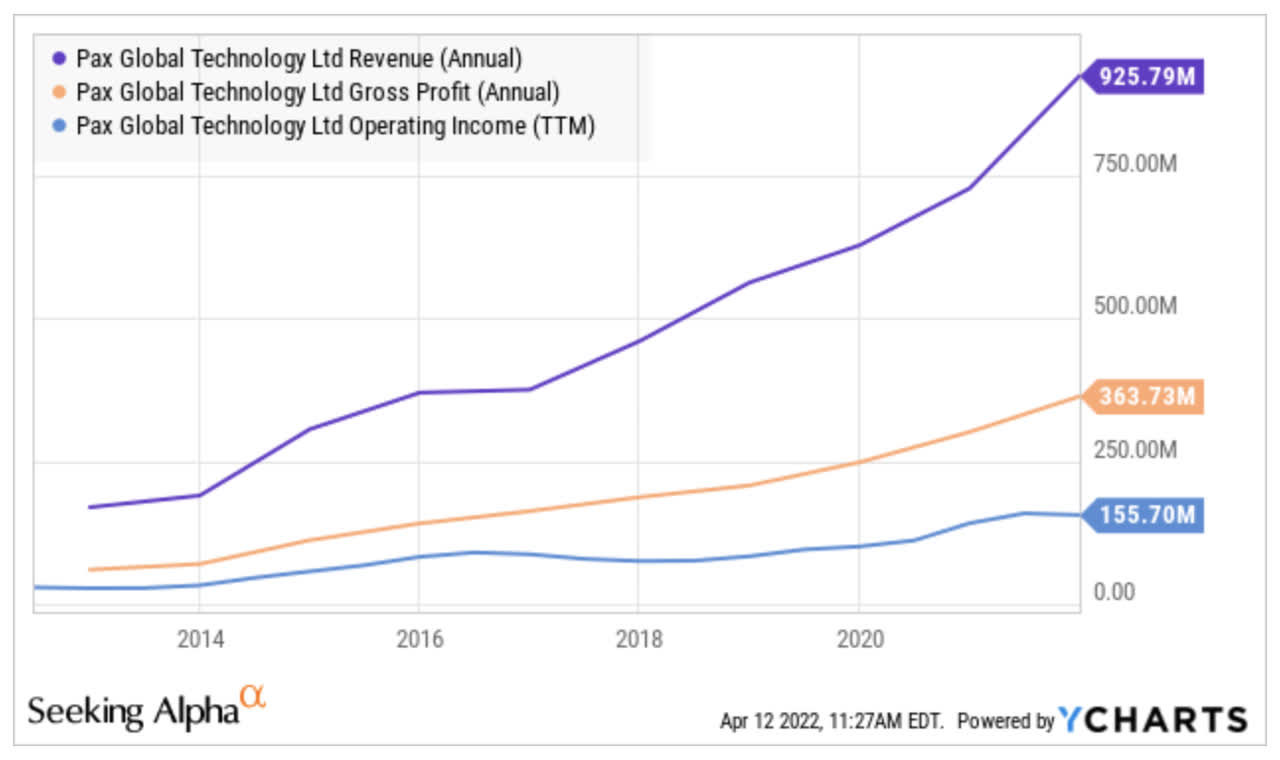

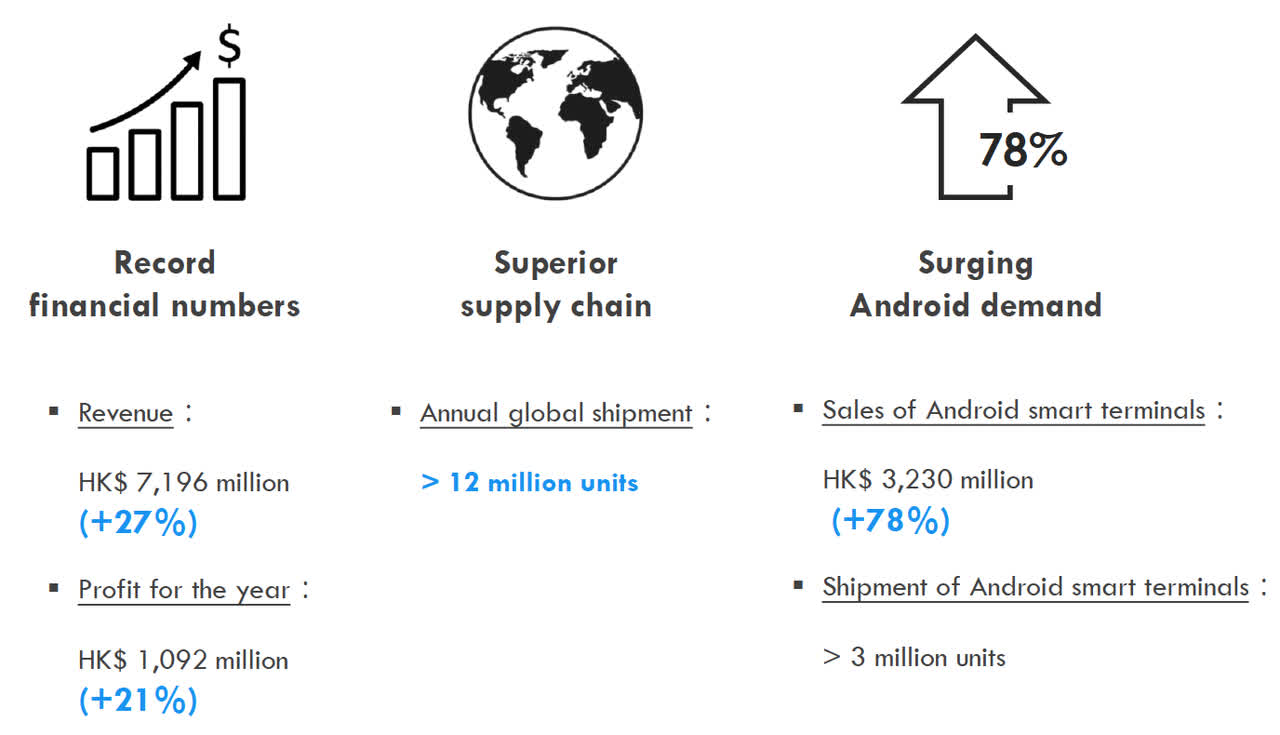

PAX surpassed financial targets despite operation and economic obstacles. It beat revenue estimates and met profitability estimates.

+Revenue grew 27%+ vs. target of 25%

+Gross profit margin was 39.3% vs. target of 38-40%

+Operating profit margin was 17.8% vs. target of 17-19%

The key highlights we want to discuss here are:

PAX’s consistency in delivering growth and profitability, PAX’s impressive growth of the Android products in the US and EMEA markets, Rapid PAXSTORE expansion, High dividend payout, and share buyback activity.

When we invested in PAX back in 2019, we thought the key to the investment case was its attractive valuation (3x EV/Net Profit, 10% growth, at $3.5/share). Now at $6.50/share, valuation attractiveness remains the case. But what is compelling is its consistent improvement in top-line growth, profitability, and visibility of future opportunities.

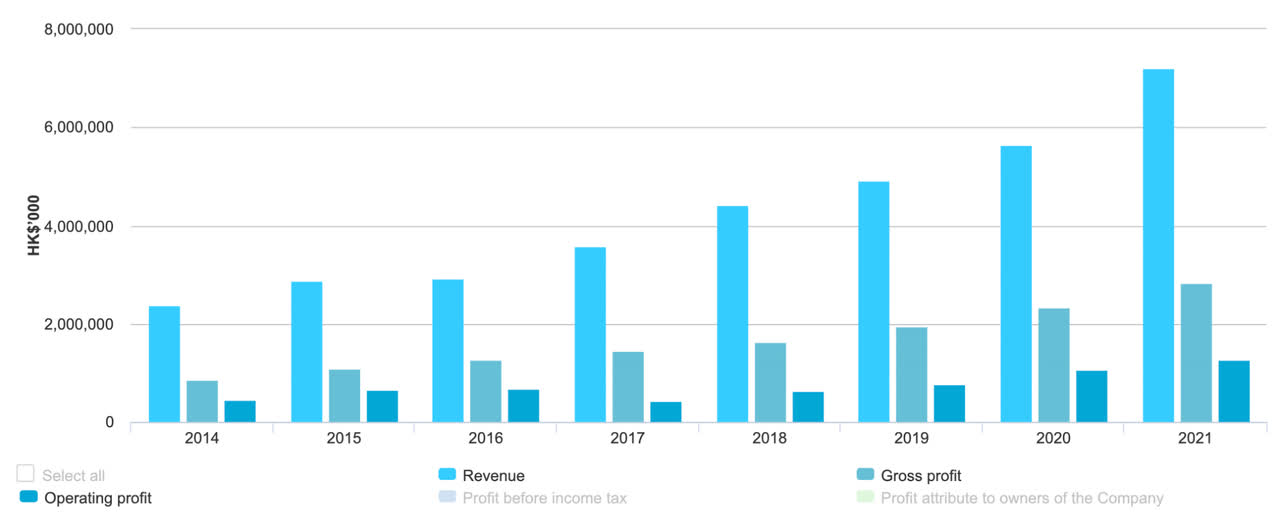

Stretching out the timeline to the last eight years, you can appreciate how consistent PAX has been. If you didn’t know PAX before and looking at the financials below alone, you would not have guessed that PAX operates in a capital-intensive, long sales cycle and a cyclical industry.

PAX’s growth

+Revenue grew to HK$ 7.2B from $2.3B, 15.3% CAGR in 8 years.

+Gross profit grew to HK$ 2.8B from $0.86B, 16% CAGR in 8 years.

+Operating profit grew to HK$ 1.28B from $0.46B, 13.5% CAGR in 8 years.

The following graphics are in US Dollars:

PAX’s revenue, gross margin, and operating margin

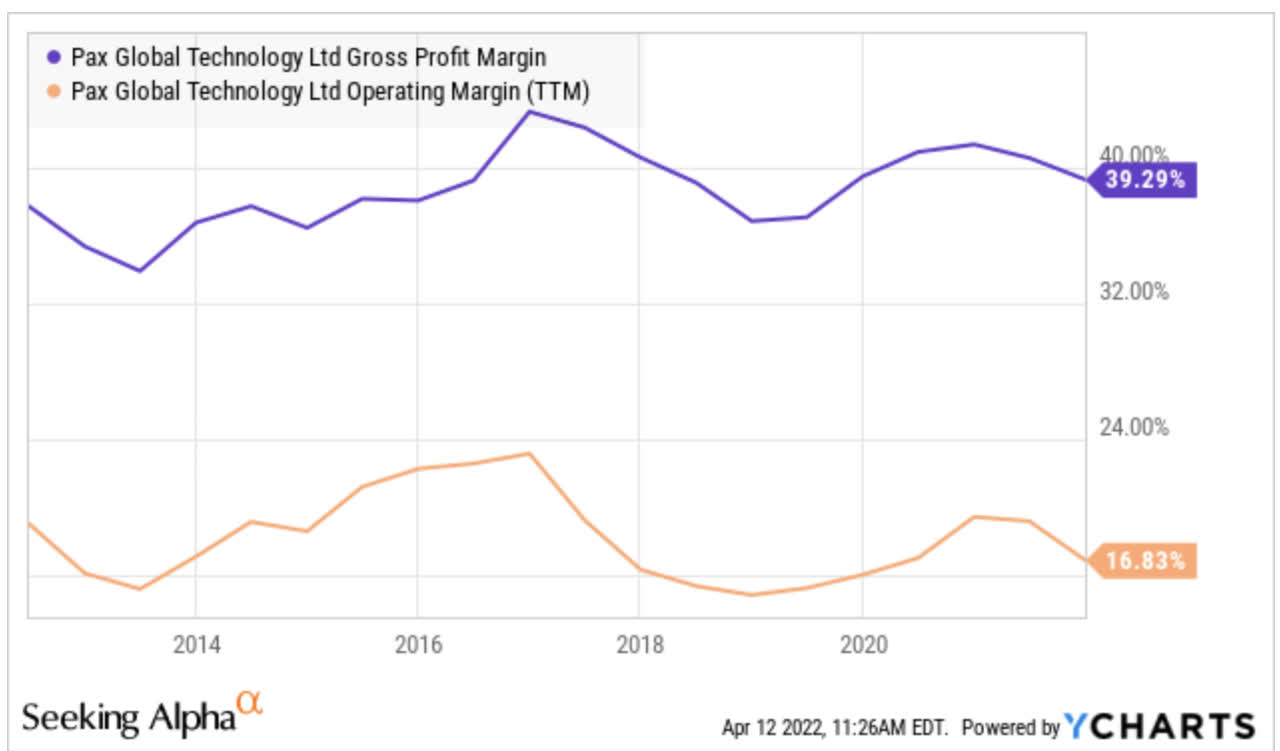

And below, you can see the consistency in gross margin and operating margin.

PAX’s gross margin and operating margin

The next thing we want to highlight is the growing importance of PAX’s Android products. They promise to drive future growth and margin expansion. The reasons are that they carry more advanced technology, sell for higher contribution profit than the traditional POS, and, more importantly, they connect users to its PAXSTORE platform.

PAX annual results presentation FY2021 (PAX annual results presentation FY2021)

Out of 12M+ devices shipped in FY2021, about one quarter was Android smart devices, but they contributed almost half of the revenue. So, Android products sell at higher prices than the traditional ones. Sales also grew rapidly at 78% YoY. In addition, what’s impressive is that these are primarily sold in the US and EMEA markets, where user requirements are much higher. It tells that PAX’s Android devices are high quality and desirable.

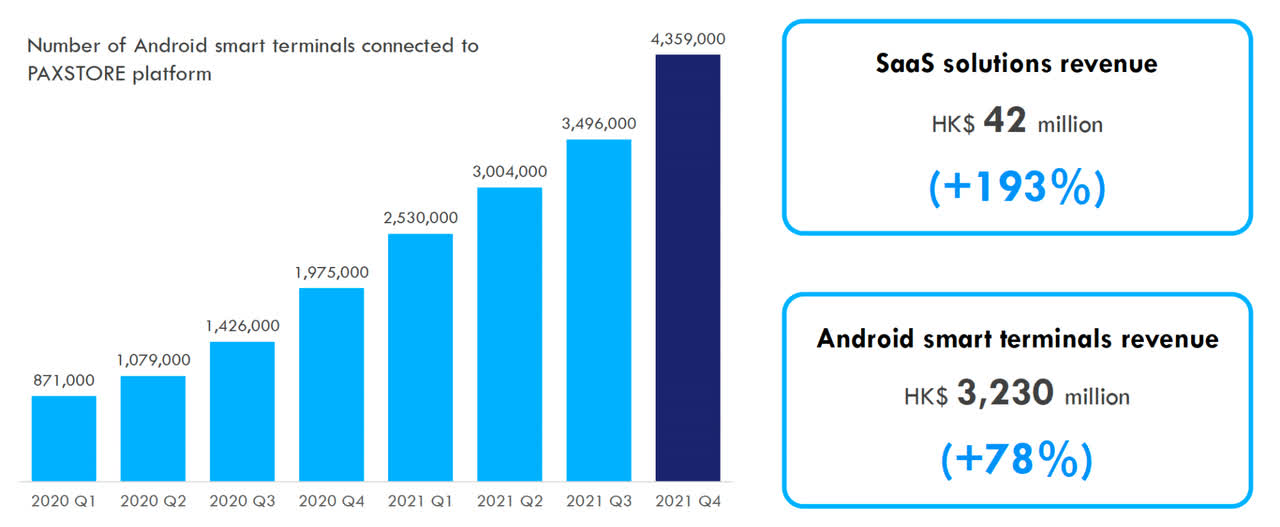

The rapid expansion in Android devices ties in with the increasing adoption of SaaS solutions on the PAXSTORE platform. In one of our previous articles, we explained the importance of this strategic move (in 2019). At H12020, only 1M devices were connected to the platform. Fast forward two years, the number has quintupled to 4.4M devices. Revenue from this segment is growing accordingly, at 193% YoY.

In FY2020, PAX targeted to generate HK$ 100M revenue by FY2023 from its SaaS solutions on PAXSTORE. Today, FY2021, it’s already at HK$ 42M, growing at 193% YoY. The speed of adoption is quite telling that it will surpass the target again.

PAXStore

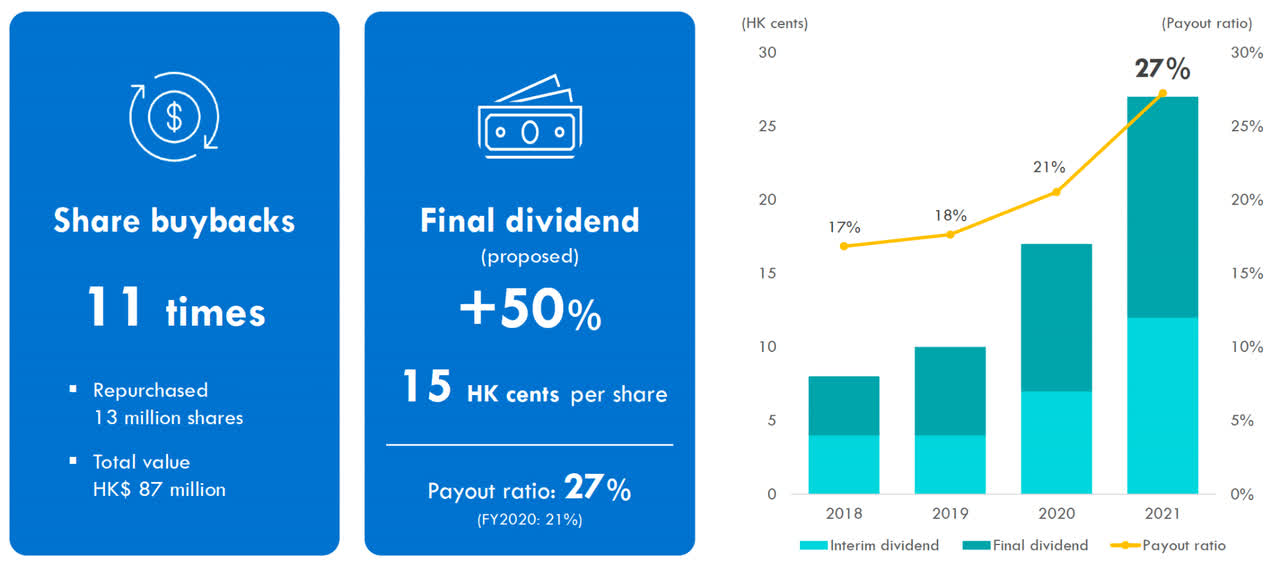

Finally, the last highlight of FY2021 was the increasing distribution of cash back to shareholders. PAX bought back 13 million shares (1.3% of the 1B shares outstanding) and announced another significant increase in dividend payment at year-end. At today’s prices, $6.50 that’s about a 6% yield in total returned to shareholders, combining the share buyback and dividends.

PAX Global’s FY2021 share buy back and dividend

FY2022 – Conservative Guidance

The management targets 15%+ revenue growth and about the same gross profit and operating margins as previous years.

PAX Global’s FY2022 guidance

If history is any guide, PAX is likely to outperform estimates again. The management has consistently underpromised and over-delivered. We like that. Have a look at the massive gap between management expectations and actual results below:

- In FY2019, they guided FY2021 to achieve ‘low-double digits’ revenue growth.

- In FY2020, they guided FY2021 to achieve ‘above 10%’ revenue growth.

- In H12021, they guided FY2021 to achieve ‘25%’ revenue growth.

The actual growth for FY2021 is 27%. Barring the US security breach, the gap would have been larger than the 2% beat. We expect PAX to beat FY2022 year guidance.

Analysts Research

The strong performance didn’t go unnoticed. Essence International’s target price was HK$10, the most conservative. Meanwhile, CGSCIMB raised the target price of PAX to HK$11.4 (or around USD$ 1.40 on the OTC), citing the current depressed valuations are unreasonable as they believe the FBI issue will not hurt its business expansion in the US and globally. Finally, China Tonghai Securities maintained a target price of HK$14.81.

Analysts report

Valuation – Still Cheap

We like to look at valuations in the context of management quality, business model quality, competition positioning, and optionality. We don’t think PAX should be trading at 7.4x P/E with these lenses.

PAX Global’s valuation chart

Historically, it is also at the lower range since 2015. Taking away the HK$ 3.56B of net cash in the balance sheet, the P/E is about 3.5x.

Will time cure it all? In the short-term, unlikely. Investors are pessimistic and scared at the moment. They focus only on what is the risk and worst outcome today.

But if one extends the investing horizon, we see a quality investment. It has a strong track record of overcoming adversities. Moreover, it has more aligned and capable management, improving business quality given the rapid rise of Android products, strengthening its competitive position, and finally, the optionality from PAXSTORE, albeit small for now.

If and when the market views PAX more favorably, it could value the company at 10-12x P/E in the short term. That brings the market cap back to above HK$ 11/share. And with the additional 15% growth by the end of this financial year, PAX shares should be valued fairly at HK $13-$14.

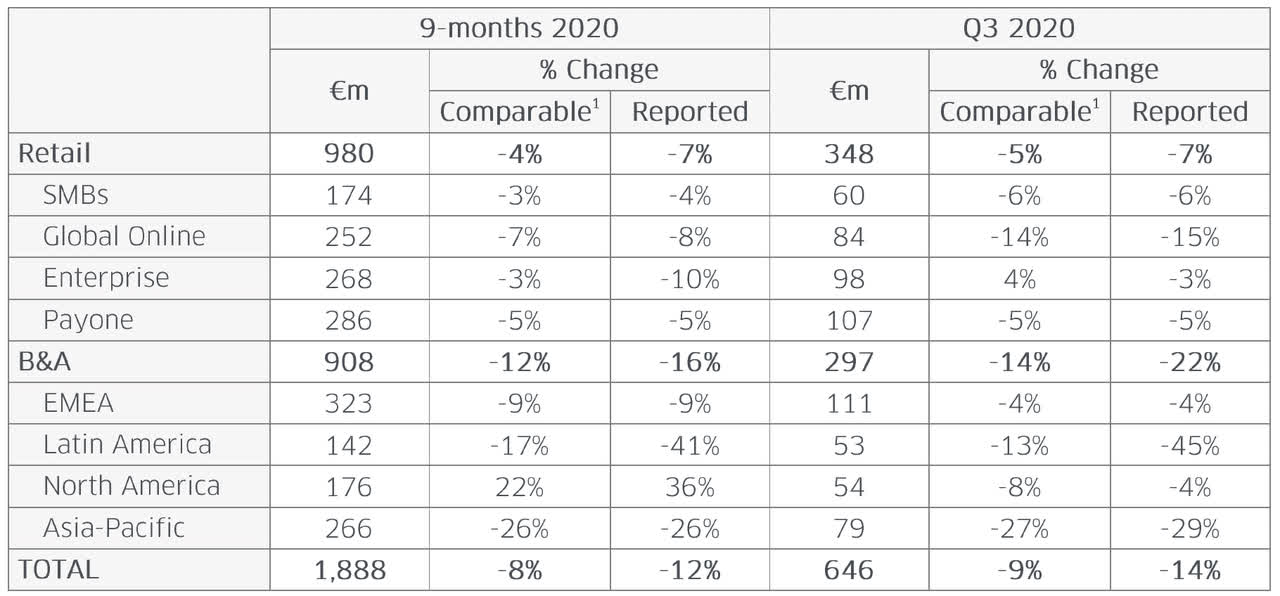

If this doesn’t sound reasonable, we remind investors that Worldline acquired Ingenico at 20x P/E in 2020 (similar to the Verifone acquisition in 2018), while its gross and net margins were 36% and 7%, respectively. Moreover, Ingenico also had a mediocre balance sheet and was losing market share in all of their regions. The table below shows that Ingenico had lost market share in all regions throughout 2020, and PAX was the main cause of this failure.

Ingenico’s growth 2020

Risks – Manageable

With a reasonable valuation, impressive historical performance, and strong guidance, what do investors worry about? We think there are a few below:

(-) FBI’s image setbacks

(-) Regional growth slows in the US – as compared to H1FY21 results

(-) Supply chain issues

(-) Capital allocation – use of excess cash

(-) Long-term technology landscape

(-) FBI’s image setbacks

As explained in the Elephant In The Room section, the setback from the FBI’s raid of PAX Florida facilities has brought unwelcomed attention. The share price bounced off the bottom from HK $4.30 but remained 35% below the peak.

(-) Regional growth slows in the US – as compared to H1FY21 results

FY2021 results show that regional growth in the US slowed down markedly to 56% by the end of the year from 72% at H1FY21. Investors could triangulate and point the finger at the security breach as the culprit.

However, we think that this is more a coincidence than a cause. In FY2021, except for LACIS, other regions have all slowed down compared to H1 2021.

US grew 72% YoY (H1’21) -> slowed down to 56% YoY (FY2021)

EMEA 63% -> 48%

LACIS 17% -> 19%

APAC 12% -> 10%

In addition, we believe the management’s response has been assuring. We also feel there was enough evidence to believe that the accusation is unfounded and immaterial. Nevertheless, to be sure, results from H1FY22 and perhaps in H2FY22 are required to confirm if the problem can be put to rest.

(-) Supply chain issues

The third risk is the supply chain issue. While this has been a big worry of 2021 in all industries, we think this is a transient issue. The management has already observed that procurement in 2022 won’t be as tricky as it was compared to 2021. The delivery time for chips has shortened from the 8-12 months previously experienced.

We find this consistent within the auto industry, where inventory level has been much larger in Q4’21 than the rest of FY2021. Thus, the stock shortage problem should be minor by the end of this year. On the other hand, if China’s zero covid policy continues for much longer, all bets are off.

(-) Capital allocation – use of excess cash

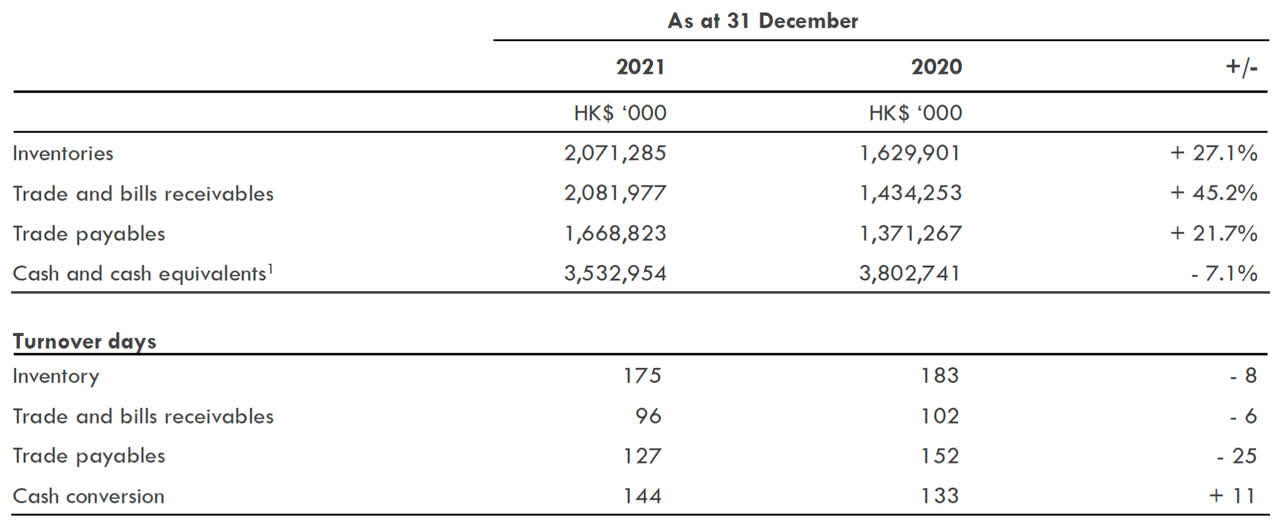

One persistent investor’s concern is PAX’s use of cash. Analysts asked this question in almost all conference calls since our first attendance in 2019. After three years, the cash level is still very high, at HK $3.5B, or above $3/share. However, we do not think it’s a major issue anymore. We understand that PAX is required to keep a handsome buffer of cash due to the 144 days cash cycle, as shown below.

Cash cycle (Pax Global)

PAX also invested HK $500M in a new Smart Terminal Industrial Park, announced in H1 ’21 results and to be ready for production by Q3′ 2023. The goal is to increase production capacity to 22M units/year from 12M units/year.

They also spent around HK$ 400M on dividend payments and share buyback in 2021. Overall, PAX spent a lot more cash than in previous years, outside of the regular business spending.

Finally, the Chairman, Nie Guoming, added that

[…] in the future, there could be opportunities for us to acquire other companies, so we need cash in preparation for that. Of course, it’s also for some contingencies, for example, in terms of our internal operations or external environments. There may be some uncertainties, so we have to prepare some cash to cater to those situations.

Source: PAX FY2021 conference call

Nie Guoming sounded very conservative. However, we can be quietly excited that M&A is in the picture. To rest the investor’s concern with the high cash level, we would say that it provides high margin safety for whatever PAX wants to do in the future.

(-) Long-term technology landscape

The biggest risk, in our opinion, is the potential disruption in the payment technology landscape. There has been a plethora of innovations around the payment space. We feel Square (SQ) and Apple (AAPL) are notable players.

Like the ‘wall-garden’ in the digital advertising business, Square aims to bring the payment ecosystem in-house, cutting out the middleman. It is difficult to imagine now. But, in the US, they have already onboarded millions of merchants using their POS terminals with the best applications and almost 50M cash app MAUs (Monthly Active Users). This feat was achieved within just ten years. Impressive if you consider it took JPMorgan (JPM) a merger and over 30 years to acquire that many customers.

The idea is that when the Square’s merchants and the cash app users transact with each other, they cut out the middleman (Visa and Mastercard). And when cash app users transact with each other, also known as peer-to-peer payment, they require no POS devices. This segment is expanding rapidly, 69% YoY in Q4’21. With the successful pilot expansion to Europe, there is a slight chance that SQ can close the loop of the payment ecosystem and form a payment ‘walled garden’ in 10 – 20years.

Meanwhile, Apple Tap-to-pay from Apple can be a competitive product to PAX’s M-series products. However, that’s not a focus for PAX’s business, which is corporate/enterprise clients. Hence, Apple Tap-to-pay primarily competes against Samsung, Huawei, and other mobile phone payment solutions. But it can be a problem as they move up the chain to produce more sophisticated POS for enterprises, such as PAX.

On balance, this isn’t a near-future issue, but indeed a potential bigger elephant in the room in 5-10 years. PAX is well aware and sees this as a positive for now. After all, PAX is the specialized and cost-efficient producer of POS devices. Square and Apple could potential be PAX’s customers. PAX has proven resilient in challenges, and we bet they won’t be sitting still.

Conclusion – A Quality Investment

A quality investment often possesses common characteristics. A visionary CEO/Founder often leads it. It possesses wide moats in network effects and high switching costs. It also has a recurring revenue business model. PAX might not appear to have many of these characteristics at first sight, but one can’t ignore its impressive and consistent performance. It speaks volumes.

PAX has 10x revenue and profit since spinning-off/IPO from Hi Sun in 2010. It has expanded successfully to the international market since 2015 by first undercutting Verifone and Ingenico in price, then competing on quality today. PAX has beaten these two incumbents in their field, US and EMEA markets, respectively. This is a strong proxy for high switching costs and a strong brand.

While there isn’t a competitive advantage in network effects yet, the growing sales of Android devices, which is already half of the total devices sold today (12M) would bring out higher adoption of applications on the PAXSTORE platform. With more devices connected, PAX could enjoy some network effects. It would also bring PAX a recurring business model that adds quality to the company.

Finally, at a valuation of 7.4x P/E or 3.5x P/E excluding cash, and 15% top-line growth, investors are projecting the worst outcome from the risks discussed. The stock price may remain depressed in the current environment, however, once inflation, the FBI’s probe, and supply chain risks subside, we believe PAX should be trading at double the current multiples, or at HK$ 12/share (trades on the Hang Seng Stock Exchange), USD$ 1.50 on the OTC.

[ad_2]

Source link