[ad_1]

What occurred

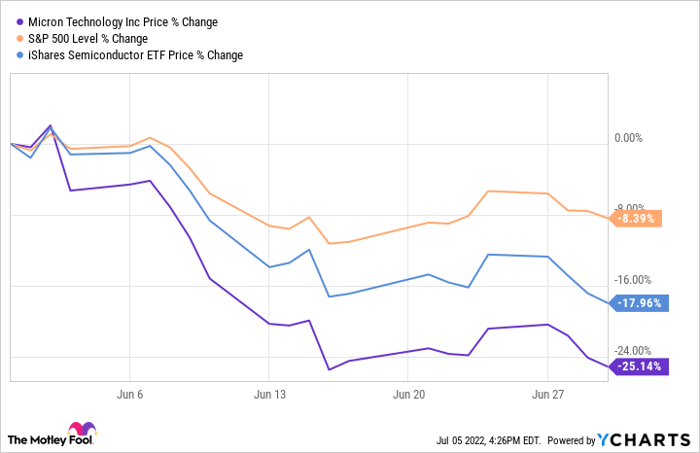

Shares of Micron Technological innovation (NASDAQ: MU) fell 25.1% in June, according to facts supplied by S&P Worldwide Market Intelligence. The inventory was down major early in the thirty day period mainly because investors and analysts are nervous about the semiconductor place appropriate now. And toward the stop of June, Micron described fiscal benefits that triggered the inventory to slide further more.

So what

A single way to track market sentiment for an whole sector is to seem at an marketplace-precise exchange-traded fund (ETF). In the semiconductor space, there are lots of selections, a single of which is iShares Semiconductor ETF. As the chart displays, traders failed to care much too significantly for semiconductor stocks in general during June, which was a drag on Micron shares.

MU info by YCharts

Source chain issues and a slowdown in the technological know-how space have investors anxious about semiconductor demand in the near phrase. And it truly is the purpose why the whole place was down in June.

The chart demonstrates two major situations wherever Micron inventory underperformed the semiconductor area: at the time early in the thirty day period and the moment late in the month. Piper Sandler analyst Harsh Kumar could be the motive Micron stock dropped early in the thirty day period. According to The Fly, Kumar reduced the value focus on for Micron inventory 22% to $70 for each share, citing a slowdown in purchaser electronics. Micron sells memory products and solutions made use of in customer electronics and is, consequently, additional sensitive than most in this regard.

On June 30, Micron documented economical results for the fiscal 3rd quarter of 2022. And Q3 outcomes had been anything but sluggish. The organization had report quarterly revenue of $8.6 billion, up 16% calendar year over 12 months. And with this record income, it claimed robust web revenue of $2.6 billion.

On the other hand, analysts didn’t like Micron’s forward advice, describing the 2nd fall. Management expects to produce $6.8 billion to $7.6 billion in fourth-quarter income. In my feeling, there are two takeaways from this assistance. First, at the midpoint of direction, this signifies a 13% year-around-yr drop — a swift reversal of its Q3 speed. Also, you can find an $800 million vary in the profits direction, reflecting outsize uncertainty from management in just the up coming a few months.

If management is this uncertain about its business prospective clients in the coming quarter, how substantially much more unsure is it for fiscal 2023? This uncertainty is a significant explanation why buyers are preventing Micron inventory right now.

Now what

Micron’s memory items are subject to a delicate equilibrium of supply and need. Demand from customers is virtually often there to some diploma. But at occasions, the market place gets flooded with memory solutions. When that takes place, Micron nonetheless sells a lot of units. But units have a lessen cost, hurting income and profit margins.

Going into fiscal 2023, Micron administration is seeking to minimize its expansion in offer so that it can preserve the ideal attainable profitability. This is just not great for advancement. But it could help maintain income move and permit management to reward shareholders as a result of share repurchases and its dividend.

10 shares we like superior than Micron Technological innovation

When our award-winning analyst staff has a stock tip, it can shell out to pay attention. After all, the e-newsletter they have operate for more than a ten years, Motley Idiot Stock Advisor, has tripled the marketplace.*

They just revealed what they believe are the ten best stocks for traders to acquire suitable now… and Micron Engineering was not a single of them! Which is suitable — they feel these 10 shares are even improved buys.

See the 10 stocks

*Stock Advisor returns as of June 2, 2022

Jon Quast has no position in any of the stocks talked about. The Motley Fool has no situation in any of the stocks pointed out. The Motley Idiot has a disclosure policy.

The sights and views expressed herein are the views and opinions of the author and do not always mirror these of Nasdaq, Inc.

[ad_2]

Supply hyperlink